Payroll Software for Australian Businesses Oct 20, 2023

These days payroll software are like a versatile tool that can connect with all the important systems in your company. It ensures that employees get paid the right amount of money at the right time, and you have the flexibility around payroll management. Most of the payroll system can handle different types of employees, like those who are paid a salary or by the hour, temporary workers, or even employees in different countries. They are also designed to handle the complications of following the tax rules and financial laws.

A business can change new employees, company mergers, or new laws. Figuring out everyone’s pay manually would be a massive job. When businesses grow, or rules change, the payroll system can adapt easily. It saves a lot of time compared to doing everything by hand. This extra time can be used for important tasks that help the business succeed.

In this article, we will talk about the five most common software packages used for payroll processing:

- XERO Payroll

- MYOB Payroll

- QuickBooks Payroll

- ADP Payroll Processing

- ELMO Payroll Processing

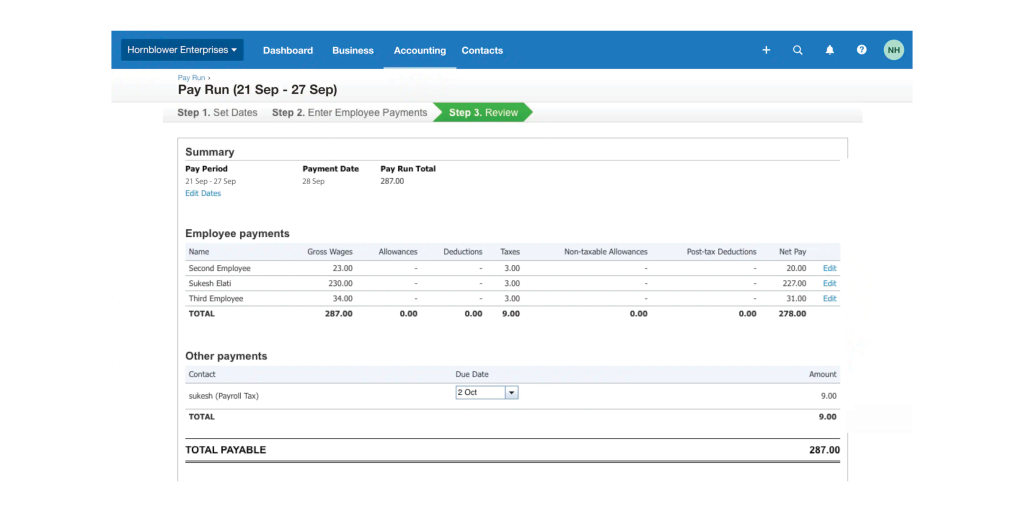

XERO Payroll

Xero is a versatile accounting software that caters to a wide range of accounting and bookkeeping needs. Xero has an integrated system that streamlines payroll and HR management. The system simplifies online pay runs, making the process straightforward and secure. You have the flexibility to manually calculate deductions, record leave, and manage payments for a small number of employees. The software is appreciated for seamlessly handling time tracking, leave management and comprehensive payroll reporting. With real-time synchronisation and accessibility across devices, Xero appears to be a versatile payroll software solution in Australia, particularly well-suited for small businesses.

What Users Like About Xero:

- Ease of Use: Several users praise Xero’s user-friendly interface and layout. They find navigating easy, especially when reconciling bank and credit card transactions.

- Automation and Efficiency: Users appreciate the automation features in Xero, particularly in payroll processing. The software offers automated tax and leave calculations, saving businesses time and reducing errors.

- Integration and App Ecosystem: It seamlessly integrates with over 800 business apps, offers user-friendly mobile apps, and provides advanced reporting for finances and budgeting.

- Flexibility for Small Businesses: Xero is lauded for being well-suited to small businesses and start-ups. It offers a range of plans, including a Payroll Only plan that caters to businesses with up to four employees.

- Compliance with Single Touch Payroll (STP): Xero’s capability to handle STP reporting is considered a strength. It ensures businesses stay compliant with ATO requirements.

Challenges for Xero:

While Xero shines in many areas, users have identified some challenges. One common concern is related to the recent changes in the layout of bills, with users expressing a desire for more customisation options and an easier-to-read format. Some users find payroll clunky and not entirely user-friendly, particularly when dealing with hourly wage calculations. Users have also pointed out the need for improved features for inventory tracking and simplified payroll processes.

Xero presents an attractive solution for small businesses seeking to streamline their accounting and payroll tasks within a single platform. Pricing starts at a competitive level for businesses with fewer than five employees, and you can scale up as your workforce grows. However, potential users need to consider the additional costs for advanced features.

Pricing :

Xero Payroll starts at $14 per month for 1-4 employees

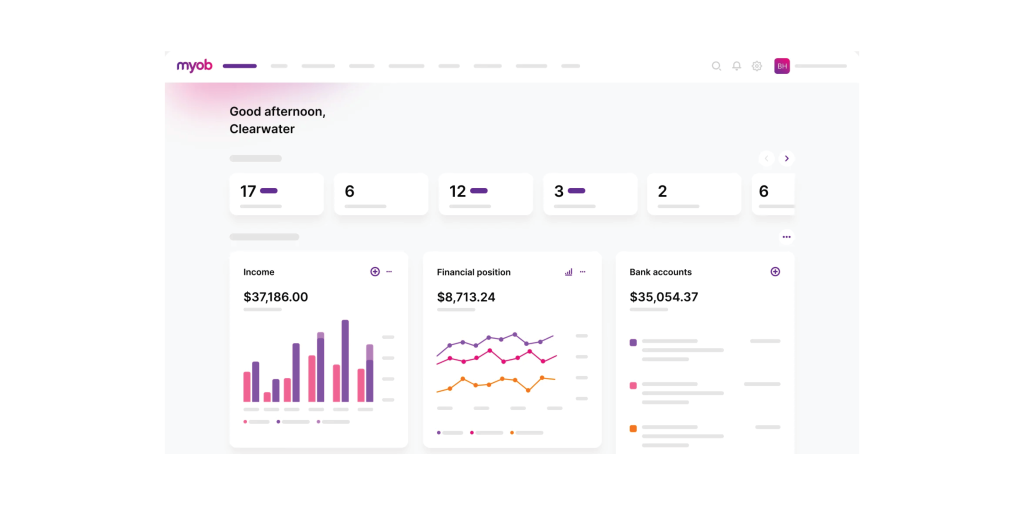

MYOB Payroll

For over a decade, MYOB has popularly maintained its position as an ideal choice of accounting software for small businesses in Australia. MYOB’s payroll management features allow businesses to tailor their payroll processing needs with flexible and scalable options as they grow. MYOB Payroll provides integrated and individual payroll management options, allowing businesses to choose best.

Some key functionalities of MYOB Payroll include seamlessly calculating superannuation (retirement savings), enabling remote employee onboarding, and maintaining precise payroll records. These features simplify the often-complex task of managing payroll, ensuring accuracy and compliance.

The software’s pricing structure is designed to accommodate businesses at different stages of growth. For instance, if you’re starting with a Pro($8/mo) or Lite ($5/mo) subscription, there might be limitations on the number of payrolls you can process. However, as your business expands and you hire more team members, you can upgrade your plans, giving you access to unlimited payrolls.

What Users Like About MYOB Payroll:

- Payslip Generation: It ensures that every essential detail, from salaries and deductions to superannuation contributions, is meticulously and accurately recorded on each payslip.

- STP Compliance: Single Touch Payroll (STP) reporting is a crucial aspect of Australian payroll, and MYOB is designed to make STP compliance easy. It enables businesses to create STP reports and seamlessly transmit them to the Australian Tax Office (ATO).

- Tax Compliance: MYOB keeps you in the loop with tax changes and makes tracking and managing employee information easy. The automated tax calculation feature uses the latest tax rates and thresholds to calculate your taxes in real time. This means you don’t have to crunch numbers manually, worry about tax law changes, or spend hours on complex calculations.

- Payroll Reports: The software provides robust reporting capabilities, allowing businesses to analyse payroll data, track labour costs, and generate detailed reports in real-time.

- Auto Updates: MYOB automatically updates in response to changes in tax legislation and payroll requirements, keeping you current and compliant.

MYOB Plan Options and Pricing:

The Business Payroll Only plan, starts at $10/month but is limited to processing payroll for up to four employees.

What Users don’t like about MYOB:

Customer Support: Several reviews mention poor customer service support from MYOB. Users report difficulty in reaching customer support and often resort to online forums and help boards for troubleshooting. This could be a drawback for businesses that rely heavily on timely and efficient customer support.

User Experience: Some users mention that the software can be buggy, and upgrades may not always address fundamental issues. Complaints on the community forum have allegedly been ignored over extended periods, which may indicate a lack of responsiveness to user feedback.

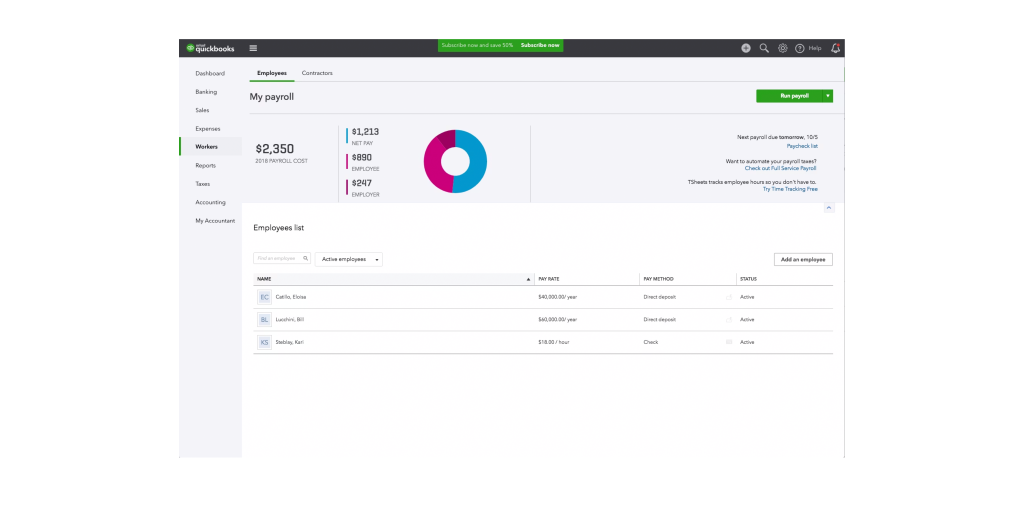

QuickBooks Payroll

QuickBooks Payroll, developed by Intuit, is a robust and comprehensive tool for efficiently managing small businesses’ employee payroll. It can handle the payroll for businesses with up to 50 employees, but it’s flexible enough to manage up to 150 employees. If you’re already using QuickBooks Online for your accounting needs, then QuickBooks Payroll seamlessly integrates, creating a unified platform for managing both accounting and payroll. This combination has earned QuickBooks Payroll a spot on the list of the best payroll software for small businesses.

What Sets QuickBooks Payroll Apart?

One of its standout features is its automated tax calculation, filing, and payment for both state and federal taxes, making tax season a breeze. It simplifies the whole process and can even assist you in filing for local taxes.

The way QuickBooks Payroll operates is straightforward. It calculates payroll automatically, taking away the complexities of manual calculations. You just need to input your employees’ information, set payment rules, and choose when payroll should run. It’s also equipped to handle independent contractor payroll and is optimised for small to medium-sized businesses.

QuickBooks Payroll distinguishes itself with exceptional features, including live expert guidance, expert review and support, 24/7 chat service, and a robust knowledge database, particularly useful for first-time users.

While QuickBooks Payroll offers a range of integrated products to build a comprehensive business ecosystem, it’s worth noting that these premium services come at a cost. If budget is a concern, more affordable alternatives are available that provide equally good solutions.

Why QuickBooks might not be suitable

- If budget is a top concern and you’re seeking a more budget-friendly payroll solution, QuickBooks might not be the best choice. It offers comprehensive features but comes at a cost that may not align with your budget.

- While QuickBooks can manage payroll for up to 150 employees, it might feel less scalable as your team approaches that upper limit.

- If your business relies on various specialised tools for accounting, time tracking, project management, and other functions, and you’re looking for seamless integration with your existing software, QuickBooks may not be the most compatible option.

ADP Payroll Processing

ADP is a solid choice for small businesses looking for straightforward payroll processing. Its extensive history and market share leadership assures you with a level of credibility that many newcomers can’t match. ADP Payroll services provide a comprehensive and user-friendly payroll management solution that simplifies payroll processing, tax compliance, and employee self-service.

What are the Key Features that Sets ADP Payroll Apart?

- Ease of Use: ADP’s intuitive and straightforward user interface. This makes it easy for businesses, regardless of size, to navigate and execute payroll-related tasks efficiently.

- Comprehensive Payroll Tools: ADP Payroll services offer many features, including direct deposit, check and debit card payment options, tax calculation and submission, claims processing, and downloadable reimbursement slips. This comprehensive toolset simplifies the payroll process, ensuring that all necessary aspects are covered.

- 24/7 Customer Support: ADP provides round-the-clock customer support, allowing users to seek assistance whenever they need it. This accessibility is invaluable for addressing issues and questions promptly.

- Employee Self-Service: ADP’s solution includes a portal that employees can use to access their pay stubs and submit claims. This self-service feature enhances the overall payroll experience for employees and reduces the administrative burden on the HR department.

- Integration Capabilities: ADP can easily integrate with other business systems, streamlining your payroll operations and ensuring data flows seamlessly between different departments.

- Support for Tax-Related Matters: ADP’s support desk can handle requests related to various tax and financial matters, such as Gratuity, Provident Fund (PF), Professional Tax (PT), Service Tax (SA), and income taxes. This makes it a one-stop solution for addressing various financial and tax-related issues.

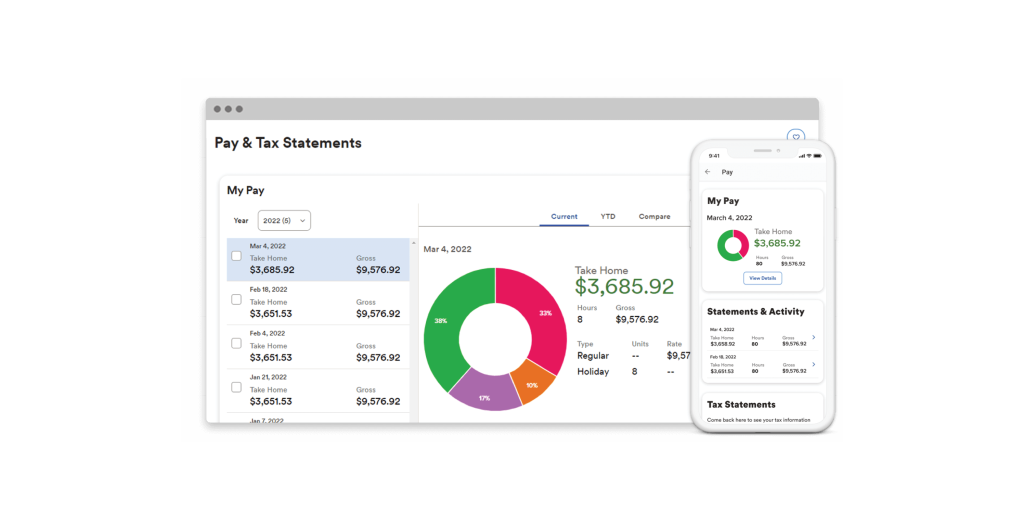

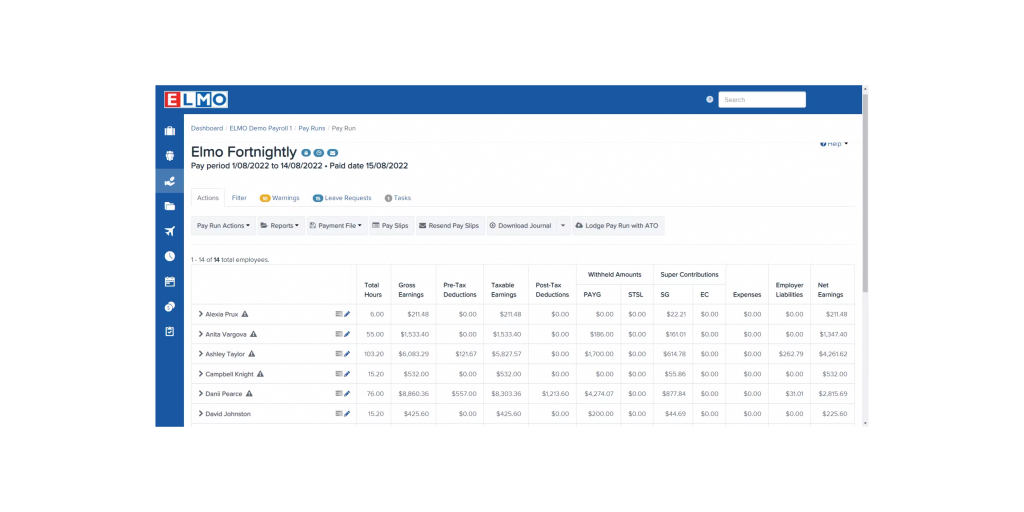

ELMO Payroll Processing

ELMO is a cloud-based solution that empowers organisations in Australia, New Zealand, and the United Kingdom to efficiently manage various aspects of their workforce, operations, and payroll. ELMO Software offers a robust and adaptable suite of cloud-based HR and payroll solutions designed to help organisations improve efficiency, compliance, and workforce management.

While ELMO has strengths in terms of integration, ease of use, and organisational connections, concerns about the implementation process, integration limitations, and ongoing system challenges need attention for a more seamless user experience.

- Seamless Onboarding to Payroll: ELMO’s platform ensures a smooth transition from onboarding to payroll. This integration eliminates the need for redundant data entry or transfers, saving time and reducing the risk of errors.

- Efficient Timesheet Management: The system offers tools to effectively organise and manage employee timesheets, making it easier to track working hours and ensure accurate and timely payments to your workforce.

- Secure and Compliant-Ready Payroll: ELMO’s payroll solution prioritizes security and compliance. It provides a secure environment for payroll processing, ensuring that your payroll operations meet all legal and regulatory requirements.

- In-Depth Reporting: ELMO’s platform allows you to generate comprehensive reports. These reports provide valuable insights and data to support informed decision-making, helping you optimize your HR and payroll processes.

- Supportive Implementation: ELMO’s support during the project implementation phase receives positive feedback. Users report that the Help Desk effectively resolves issues within a reasonable time frame, typically within 24 to 48 hours.

Cons:

- Disjointed Implementation: Some users mention that the early implementation and project management stages have been somewhat disjointed and poor. They feel there hasn’t been enough workflow promotion and details regarding resource allocation for a successful go-live.

- Integration Limitation: ELMO’s inability to integrate with its own HR module is a drawback. This limitation results in the need for double-capturing leave requests, which can be time-consuming and inefficient.

- Ongoing System Challenges: Some users report ongoing challenges with the system even months after initial implementation. This suggests that issues may need to be addressed to ensure a smooth and consistent user experience.

Payroll Processing with Team SBA

Team SBA offers Payroll Processing Services for your employees. Outsourcing such administrative tasks to Team SBA allows your HR and finance teams to concentrate on more strategic business activities, knowing that your employees will be paid correctly and on time. We streamline your payroll processes, making it easier for your business to succeed in today’s ever-changing business world.