Reviewing costs and expenses or “There’s a hole in my bucket!” Oct 31, 2013

In this blog, Graham Le Roux, owner of Constantia Management Group examines how professional practices can effectively review their costs and expenses during downturns.

Reviewing costs and expenses or “There’s a hole in my bucket!”

When there is a downturn in the economy it is a good time to examine and review all expenses. There are risks and costs associated with a program of expense/costs review BUT they are far less than the long range risks and costs of comfortable inaction!

The problem in the downturn environment is that revenue (income) tends to contract whiles fixed costs tend to remain static. If variable costs contract in concert with contracting revenue then you are relatively OK until you reach your break even point after which it will be costing you money to make a sale! So as they say in modern parlance “What’s to do?” In my experience suitable actions arise in two dimensions:

Dimension 1 – Variable Expenses

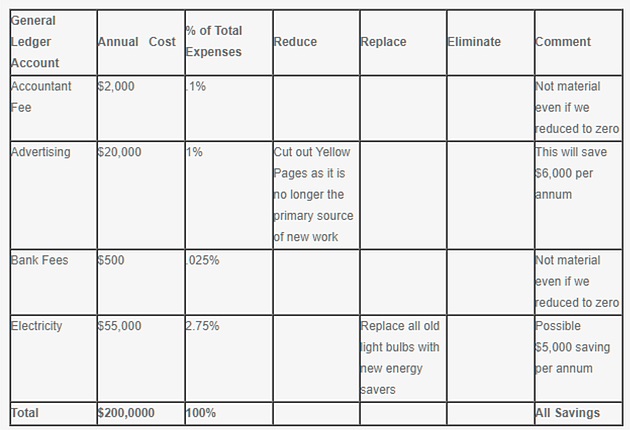

These are expenses directly associated with production. Good examples include the cost of the container into which you put your product or the paper on which you print your report if your deliverable is a professional service. Therefore prepare a variable cost review checklist like this:

Variable Cost Review Checklist (example for illustrative purposes only and total shown is not sum total of figures shown)

Dimension 2 – Fixed expenses;

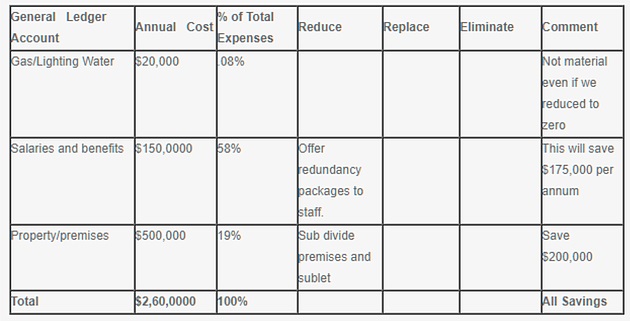

Fixed expenses are harder to review and they do not directly vary with production.

Fixed Cost Review Checklist (example for illustrative purposes only and total shown is not sum total of figures shown)

Beware of unintended consequences

By offering redundancy packages to all staff you might end up losing key staff as well as corporate knowledge held by individuals and not the organisation (only they know how to do certain stuff).

By removing resources you are changing your effectiveness in terms of materials and assets. If you cut too deep you might not be able to respond quickly (nor easily!) when the economy recovers.

Steps to improving cash flow

1. Review all Variable Expenses

2. Review all Fixed Expenses

3. Identify possible cost savings and construct review actions.

4. Consider all consequences

5. Implement agreed savings/cost reductions

6. Review the results of the cost reduction exercise.

Core message

Reducing expenses is not an easy activity and should be undertaken with sensitivity and extreme caution.

Manifesto

Examine all expenses, do not leave out any sacred cows.

Quick steps

• Check if there are any redundant assets which could be sold.

• Identify those expenses which account for 80% of your total expenses – review these first.

• Some staff may be approaching retirement age – consider offering these staff an early retirement incentive.

• Cease employing casuals and part timers.

Strategies

• Ensure you always have an up to date Purchasing Policy

• Outsource some of your back office activities.

About The Blogger

Graham Le Roux is the owner of Constantia Management Group and has over 15 years of experience in law firm management. He was an Australian Awards evaluator for 10 years and has helped numerous firms achieve ISO certification. Graham is passionate about simplifying the overwhelming data bombarding managers of law firms and identifying key actions to improve Profitability, Cash Flow and Value.

Contact him on 0419235060 or at [email protected]